Note: The author would like to thank Frances Coppola for reviewing earlier drafts of this article and and providing excellent insight on modern monetary theory (of course any mistakes are mine). What follows is an argument of purely theoretical value intended to show that other than purely ideological obstacles, Keynesianism and Monetarism are suggesting the same thing and any further discussion is redundant.

John Maynard Keynes and Milton Friedman, other than being the two most influential economists of the 20th century were the originators of two schools of thought which have sustained a debate for a full 50 years (Friedman published his "A Monetary History of the United States 1867-1960" book in 1963). Although both schools of thought are in agreement that the aggregate demand curve (i.e. output) is downward-slopping they are in disagreement about what causes the curve to shift.

John Maynard Keynes and Milton Friedman, other than being the two most influential economists of the 20th century were the originators of two schools of thought which have sustained a debate for a full 50 years (Friedman published his "A Monetary History of the United States 1867-1960" book in 1963). Although both schools of thought are in agreement that the aggregate demand curve (i.e. output) is downward-slopping they are in disagreement about what causes the curve to shift.

Monetary Theory

Monetarists use the quantity theory of money in their view of aggregate demand:

M*V=P*Y (1)

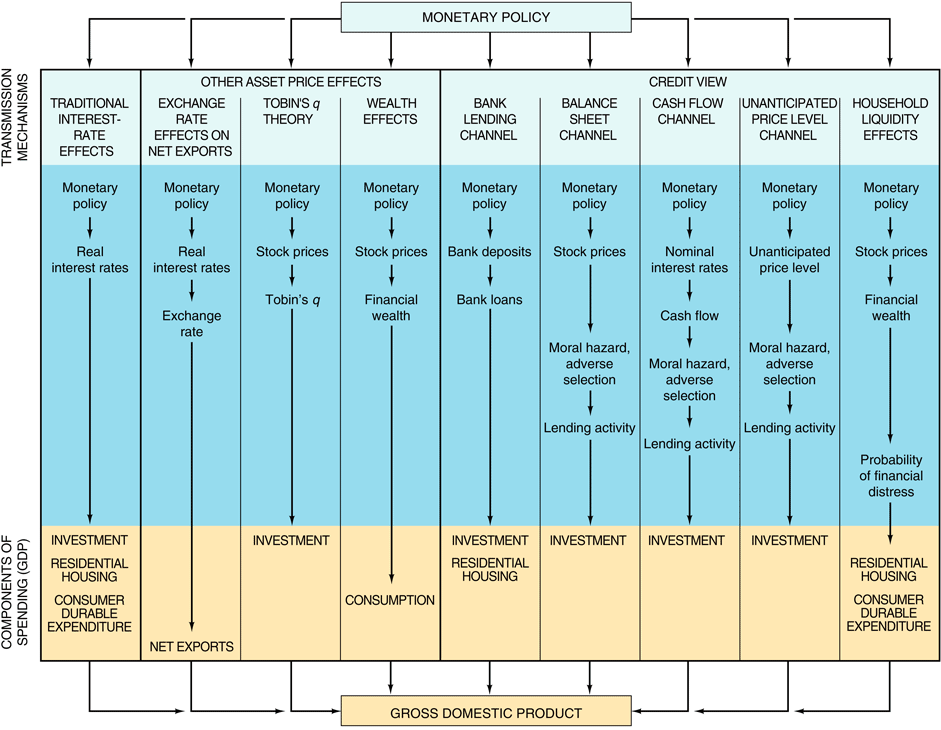

with M being the quantity of money in the economy, V the velocity of money (i.e. the average number of times per year that a unit of currency is spent on final goods and services), P is the price level and Y is aggregate real output (or equivalently, real income). Using the above identity, monetarists argue that in order for output to increase, a rise in the money supply has to occur. (for example, if V=1 and P=2 are constant, then in order for Y to increase M has to increase). The monetary policy transmission mechanisms are summed up in the following table (Click to Enlarge):

|

| Source: Frederic Mishkin, Economics of Money, Banking, and Financial Markets, 9th edition |

Keynesian Theory

In the Keynesian framework

Y=C+I+G+NX, (2)

with Y being output, C consumer expenditure, I is planned investment expenditure, G government spending and NX being net exports (i.e. Exports-Imports). In the Keynesian view, if the price level (P) falls, while M is constant, the quantity of money in real terms is larger, thus causing the interest rate to fall which in turn makes investment grow. Thus, output (Y) grows as well. A similar argument is made by saying that after the interest rate falls, currency depreciates, net exports increase thus output increases again.

The main difference between the two theories is that Keynesians believe that factors other than the money supply are also important in causing the aggregate demand curve to shift. More importantly, it is the change in Y which causes the change in M. Increasing the current state of output depends on factors include manipulation of government spending and taxes, changes in net export and changes in consumer and business spending.

Two sides of the same coin

The Keynesian premise states that increased government spending or a reduction in taxes makes people have more to spend than before; either because they give away less in taxes or because increased spending increases their income. Here, the debate of crowding out private spending occurs (i.e. if the increase in government spending will induce a decrease in other parts of the output equation, notably private investment and spending, thus leaving it unaffected). Nevertheless, crowding out only occurs when the economy is in full capacity and not at any other level (the only other possibility is when the state effectively steps in to take private sector jobs, yet this is irrelevant of whether the approach is one or the other). However, what most monetarists do not observe is that the case of government spending not being done by issuance of government bonds (i.e. borrowing) but by printing new money, is practically the same as increasing money supply in the first case of the above picture (although in the modern economic system either borrowing or printing would be more or less the same). Thus, if increased government spending is done via the printing machine then the monetarists' argument of crowding out the private sector cannot hold as it would necessarily have to hold when we use the monetarist doctrine (in which case crowding-out does not happen as theory and practice state). This means that both the Keynesian and the Monetary doctrine are in fact promoting the same issue, albeit with different ideology.

Either increasing government spending or increasing the amount of M in

the economy would have the same result. Printing money would equal increasing

government spending (e.g. build more roads) since you actually have to use that money somehow and not just have them lying around; and you

cannot throw it over the country with a helicopter (well you can, but

it's not a very good policy!). Thus, unless we speak of creating money

and giving them to the banks so they can increase lending (which again is not good policy as it is subject to the whims of the banking system),

printing is the same as increasing government spending (one may argue that

the money can be used to finance the same amount of spending as before,

yet this will also affect the economy albeit indirectly through decreased supply of government bonds).

It appears that Monetarists cannot accept that changes in consumer and business spending also affect output. This is somewhat against their own logic once again: Note that in identity (1) the quantity theory of money states that "keeping all else constant" only M can change Y. Yet, an increase in consumption (keeping M constant) means that the average times a euro is spent over a year (i.e. V) increases. If V increases then (keeping everything else constant) it means that either P or Y have to increase. Nevertheless, if P (the price level) is affected only by the money supply in economy (according to the monetarist theory), then it cannot be increased without an increase in M. Thus the only part of the equation which can be increased is Y.

The point here is that inflationary pressures will occur whatever the approach may be. Yet, this is exactly what policy should be aimed at: as real interest rates increase and nominal rates decrease during a recession (just have a look at Japan currently or at the US during the Great Recession) the only way to induce spending is by increasing these rates. Both theories provide some good tools for this although they present it differently:

1. Monetarists say that an increase in the money supply will increase output.

2. Keynesians say that an increase in government spending or a reduction in taxes will do that.

Nevertheless, when we replace "government spending" with "government spending via increasing money supply" instead of borrowing then the Keynesian doctrine is identical to the Monetarist one. Krugman and DeLong point out that in a liquidity trap government lending will not cause interest rates to rise. In addition, Krugman comments that the IS-LM (Keynesian) model equals the Modern Monetary Theory one once a country finds itself in a liquidity trap. The argument here is that the two approaches are the same not just in a liquidity trap setting but in recessions in general (in a liquidity trap it would be actually easier to go through with fiscal stimulus since it does not require the same amount of commitment as a monetary expansion). Then, since crowding out effects do not occur during a money supply increase if we trust the Monetarist view on the subject, we are forced to conclude that they do not also rise even if the channel is increased government spending.

In practice, both theories should work well in a recession as long as the government steps in to cover for the private sector's unwillingness to invest or consume; both are also expected to be inflationary and cause private sector crowding out at times where the economy is operating at full capacity (or if supply-side inefficiencies occur). Thus, what is left when all economic arguments lifted is pure ideology: is a large government sector better than a small one? And the answer, similar to all issues of economics and life is, it depends...

In practice, both theories should work well in a recession as long as the government steps in to cover for the private sector's unwillingness to invest or consume; both are also expected to be inflationary and cause private sector crowding out at times where the economy is operating at full capacity (or if supply-side inefficiencies occur). Thus, what is left when all economic arguments lifted is pure ideology: is a large government sector better than a small one? And the answer, similar to all issues of economics and life is, it depends...

Well, the idea of a liquidity trap seems to run counter to Monetarism, and most Keynesian theory(Heterodox) would tell you that V is unstable, and the central bank's efficacy is largely psychological.

ReplyDeleteFurthermore, you are correct that both schools of though wish to boost Aggregate Demand, but the similarity ends there.

Economic Arguments are inhenrently ideological. Every recommendation you make reflects your ideal view of society, your political view.

It is somehow common sense that V is unstable. Yet, even under the premise that V is constant Monetarists cannot claim that Keynesianism is faulty. In fact, although the causality they promote is contradictory it is true that either increasing money supply or increasing spending will have the same results in both recession and expansion.

DeleteObviously ideology always has something to do with Economic arguments, although our era should be the one to signify the Death of Ideology.

TESTIMONEY OF TRANSFORMATION WITH THE HELP OF LEXIELOANCOMPANY@YAHOO.COM

DeleteI am writing this Testimony because am really grateful for what MARTINEZ LEXIE did for me and my family when I thought there was no hope he came and make my family feel alive again by lending us loan at a very low interest rate of 2%, well I have been searching for a loan to settle my debts and bills for the past months all I met scammed and took my money total 6,500usd until I finally met a God sent Lender. I never thought that there are still genuine lenders on the internet but to my greatest surprise i got my loan form this great company without wasting much time, so if you are out there looking for a loan of any kind for business or other purposes i would advise you to email Mr MARTINEZ LEXIE via: ( Lexieloancompany@yahoo.com ) OR text: +18168926958 and be free of internet scams. thanks… Jenny Hills Alcott Resident: Los Angeles California, United State

Testimony on how i got my LOAN.....(Brianloancompany@yahoo.com)

DeleteHello Everyone, I'm Harvey Lee a resident/citizen of the United States of America.I am 52 years of age an entrepreneur/businessman. I once had difficulties in financing my project/business.If not for a good friend of mine who introduced me to Mr Chester Brian to get a loan worth $250,000 USD from his company. When i contacted them it took just 48 hours to get my loan approved and transfer to my account after meeting all their modalities i to their loan agreement/terms and conditions. Even if you have bad credit they still offer there service to you. They also offer all kinds of loan such as Business loan,Home loan,Personal loan,Car loan,Loan for Business start up and Business Expansion. i don't know how to thank them for what they have done for me but God will reward Mr Chester Brian mightily.If you need an urgent financial assistance you can contact them today via this email (Brianloancompany@yahoo.com) or text +1(803) 373-2162 and also contact there webpage via brianloancompany.bravesites.com

FINANCIAL RESTORATION: fundingloanplc@yahoo.com

DeleteHello am Nathan Davidson a businessman who was able to revive his dying business through the help of a Godsent lender known as Jason Raymond the CEO of FUNDING CIRCLE INC. Am resident at 1542 Main St, Buffalo, NY.. Well are you trying to start a business, settle your debt, expand your existing one, need money to purchase supplies. Have you been having problem trying to secure a Good Credit Facility, I want you to know that FUNDING CIRCLE INC. is the right place for you to resolve all your financial problem because am a living testimony and i can't just keep this to myself when others are looking for a way to be financially lifted.. I want you all to contact this Godsent lender using the details as stated in other to be a partaker of this great opportunity Email: fundingloanplc@yahoo.com OR Call/Text +14067326622

What actually happens operationally when a government increases net spending (taking taxation into account)?

ReplyDeleteThe government spends by instructing a private bank to increase someone's deposit balance in the financial system. The Fed then increases that said bank's reserve balance so that the bank's financial assets and liabilities are in balance. The government then issues a treasury bond which reduces the bank deposit balance by the same amount. This reduction in deposits leads to a reduction in the bank's reserve balance. The government spending in effect has redistributed bank deposits within the financial system while also creating an interest bearing security, treasury bond.

In this financial system, treasury bonds can always be used to create new bank deposits endogenously when part of a collateral agreement. The private sector in effect can "monetize" (a word I despise)the treasury security by creating new deposits via credit creation via collateralize lending.

Also, QE (any OMO) will lead to an asset swap facilitated by the Fed where reserves replace treasury securities held by the private sector.

In reality, I see little net difference (aside from distributional effects) between having a government spend via issuing treasury securities or by "printing money" which I think means for the Fed to issues reserves against the new spending.

The government spending need not have large distributional effects if all spending happened on an equal per capita basis. The government isn't "spending" in the usually sense (making investment decisions in the real econ), all they would really be doing is instructing the financial system to increase everyone's private bank deposit balance by equal amounts. The government spending could literally be the government sending out checks of equal amounts to all citizens. The line between monetary and fiscal policy seems to be a bit blurry here as well.

You are right up to a point. This is what happens when the government increases spending via increasing its deficit (i.e. issuing bonds/Treasuries).

DeleteThe difference between printing and spending is that printing is a direct debit on the depositors without any other decrease (other than the Fed's books obviously). Still more importantly, this increase in spending means that inflation will rise which is what we want in periods of recession/depression. Printing is not just redistributing just like QE is. It is in fact a direct intervention to the market, increasing both the money stock and inflation.

Your last paragraph omits what you have described in your first. And printing does not equal helicopter money. It's just increased spending, yet paid by printing, thus increasing money and inflation (and expectations).

"Your last paragraph omits what you have described in your first."

DeleteGovernment spending via issuing treasury securities does redistribute bank deposits, but the newly created treasury security can always be used by the private sector to create new bank deposits ex-post.

The question is what happens if the government does not issue a treasury bond at all to cover the net spending? The banking system's reserve balance held at the Fed would increase, and a depositor's bank account would increase.

This does not cause a redistribution in bank deposits, but it also does not create a new treasury security held by the private sector.

Their are two main distinctions in the government's interaction with the financial system and real economy. One is that the government operation/spending results in either a possibly permanent increase in fed reserves (monetary base) or treasury securities held by the private sector.

The second distinction that would occur regardless of the above is whether the government directly decides to interact with the real economy. As you state, the government can chose to solely instruct the banking system to directly debit a depositor's bank account (or write a check directly to a depositor). This has no direct inflationary outcome unless the depositor uses the increased bank deposit balance to acquire goods or services.

Or the government could decide that they will seek to acquire goods and/or services themselves (direct new spending). The financial results are the same. There will either be an increase in the bank's reserve balance or an increase in treasury securities outstanding to offset the seller's bank deposit increase. Unlike a direct debit, this has a direct inflationary outcome.

"Still more importantly, this increase in spending means that inflation will rise which is what we want in periods of recession/depression."

I am not sure that increasing inflation via direct government involvement is what is needed immediately after a credit bubble and financial crisis that left many with negative equity to the point where many households are seeking to paydown bubble era debts. A government/CB operation that directly debits account balances fairly (on a per capita/person basis) can work to speed up the deleveraging process while indirectly inducing the private sector to increase spending on goods/services if the program is large enough. The program if large enough could help repair the troubled private financial balance sheets while also increasing employment and production.

"And printing does not equal helicopter money."

What is printing? Is it not a debit to the private sector offset by an increase in the monetary base rather than treasury issuance? How is this different than helicopter money? Unless helicopter money is an operation that is strictly defined as a procedure solely initiated by the Fed rather than congress via the treasury. The end result is the same, the debit results in an increase in reserves instead of treasury securities.

Well, let's take it from the start:)

Delete1. "the newly created treasury security can always be used by the private sector to create new bank deposits ex-post" Up to the point where banks are allowed (or willing) to lend that is. If banks do not lend then no new deposits are created. The money multiplier does not work via deposits but via regulatory capital (have a look at this)In fact in this scenario, the whole system is at the mercy of the banks.

2. Maybe I should have specified that direct new spending was in my mind when I talked about increased spending. Yet, in my mind, there exists no other way of increasing government spending. Buying back treasuries is not government spending (it is monetary not fiscal policy) since it does not involve direct intervention in the markets. The government, as well as the private sector, is at the willingness of the banks, which may (or may not) lend out some amount of what funds they possess if they wish (and they do not always wish to lend).

3. If the government chooses direct spending, then the outcomes are not the same as debiting a person's account. The reason is simple: demand is now higher (although not permanently). Thus, inflation rises (according to both Keynes and Friedman).

4. We need inflation, yet as I said in the previous comment, we need it in recessions and not at the start of a credit bubble or a financial crisis. (Besides by definition a semester has to pass in order to confirm a recession). Yet, deflation is much worse than inflation, especially if debt is high. The reason is more than obvious.

5. I disagree with directly debiting everyone's account because I do not believe that this policy can ever be implemented in the real world (although Australia has done it, my notion is that it's benefits are rather limited). Just increasing deposits does not cure anything, much less increase demand for either money or goods. If every time there is a crisis, the government spurts out money, you may imagine the kind of moral hazard this would create.

6. What you are describing in your second-to-last paragraph is in fact helicopter money. Giving away money is helicopter money; increasing government spending is not. (have a look at this article)

#1

DeleteAgree that the banking system and shadow banking system rule when it comes to the creation of new credit/bank deposits. However, treasury securities are highly in demand as prime collateral. Unless something changes, treasuries are important securities when it comes to repo. As a result, new deposits can be created using this security via repo/credit creation.

#2

I agree with the idea that ex-post swapping reserves for treasury securities is a feature of monetary policy. Reserves, fed liabilities, which are now in excess pay lower returns than t-secs, but are nominally stable in terms of price. This policy is indirect and relies on the market participants and real economy to adjust in beneficial way for it to have positive effects. This is not what I was referring to, but it does highlight that swapping t-sec for reserves is somewhat immaterial which suggests that the government spending the preceded is not depended on treasury issuance as reserves are not all that different.

#3

Direct government spending results in an immediate increase in demand which results in an increase in price inflation all else being equal. However, a government program that involves increasing a citizen's bank account balances through the banking system can lead to an increase in demand through the choices of the citizen receiving the increase. The risk is that the citizen may not spend on new goods and services. At that point, if the program is large enough you have to ask yourself why people are still choosing not to spend despite such an operation which has not been tried in the US.

#4

Do we really need inflation? What just happened? We had a massive credit bubble collapse that involved a households largest lifetime asset, housing. The collapse has left households with two problems. First, their illusion of using their home to retire has burst. As a group (at least in the US) households do not have enough financial assets to retire on.

Second, households took on bubble era debts which now are being repaid with lower real wages partially due to high unemployment. It is no surprise households refrain from spending down their financial assets/deposits in light of these two factors.

Is a higher price level really what is needed? Wouldn't it be better to help alleviate the problems in the private balance sheets especially in the HH sector? A government spending program that centers around both direct spending and check writing to citizens could be helpful. That said, price inflation would be a likely result of repairing private balances, unless debt writedowns are forced which is deflationary. As you state the inflationary route is preferred since the debt contracts are nominal.

5.+6. A government writing checks which force banks to adjust deposit balances up for citizens(offset by increased fed reserves on the bank's asset side), is functionally the same as helicopter drops (giving away money). The difference being that the treasury/congress initiate the check writing/helicopter drop instead of the central bank (who is not currently mandated to do so). This is where fiscal/monetary policy sort of merge. This is not just swapping reserves or treasury bonds (buying back bonds).

DeleteExcellent point on moral hazard. This solution is not a panacea and has its own costs. However, so does a government spending program. Government spending programs rely on government officials to make good spending decisions which may take quite a while. They involve private contractors that attempt to enrich themselves. A government operation that involves both helicopter drops/check writing plus direct government spending could go a long way toward repairing private financial balances while increasing aggregate demand directly. This would have inflationary consequences which like you said is preferred to deflation given that financial contracts are nominal.

I did read the post you provided in #6. The helicopter drop/check writing is described as a fiscal policy which is what I have attempted to do above. It is technically government spending that does not involve the government purchasing goods or services directly.

If this program is politically not feasible because of a misplaced worry on the government debt (aka total treasury securities held by the private sector), than as the VOX article states, use the CB to swap treasuries for base money.

Essentially the point of a program is not only to increase demand directly, but to provide the society with financial stability after a financially destabilizing credit bubble burst. If you can provide your citizens that, they will spend, demand will be higher, employment and output will improve. This would be inflationary to a point. Isn't that what we want after a financial crisis?

Also, I really appreciate taking the time that you put in to read/respond. You have provided some great blog posts which I just found and am reading through.

DeleteOn points #1 and #2: Yes but in order for the banks to use them as collateral they have to lend first. Otherwise they do not need it. In addition, price may be stable, yet real returns differ. And in bad times, safer and little return is better than risky ones(in the banks' minds at least)

Delete3. Exactly as you put it: "through the choices of the citizen receiving the increase". Can we trust the citizen to spend? And can we blame him if he doesn't? The answer would be negative to both. The reason is uncertainty and fear and we cannot wipe these off even with a cash injection in his account.

4. I think you are confusing increased inflation with asset bubbles. The latter is a terrible thing (as we can all understand). Inflation (or expectation of inflation) boosts businesses and provides an incentive to investment. On the other hand, deflation provides an incentive to hoarding and decreases both consumption and investment. Thus, we need a higher price level, not to sustain or repeat the bubble, but to provide incentives for people to let go of uncertainty and fear. Besides, you do remember than with deflation, the cost of the loan increases instead of decreasing every year (in real terms that is). Your proposals about spending and check writing sound nice but they do promote moral hazard...

5. Yes writing checks and helicopter money are the same. Still, spending (which is what helicopter money still is) is fiscal policy. You are right that a government spending program is not a panacea. Yet, spending programs might also include (or should focus) start-up funding (creates more jobs and growth), training the unemployed while simultaneously providing them with some income, etc. The list is not just new projects by the government, although obsolete politicians and policymakers tend to focus on that. Both solutions could also work but then the moral hazard issue again arises...

As with respect with the Vox article, then yes its feasibility is not doubted. It's ability to make an impact is what appears to be rather uncertain.

Since you have been a great discussant I would appreciate your thoughts on something: I have been considering that an alternative policy (although similar to helicopter/check writing) would be to increase public servant salaries during a recession. It might appear counter-intuitive but it might work if they choose to spend more...

Thanks for your kinds words and the kind email btw. I have responded to that as well

#1+#2

DeleteAgreed. If the treasury securities that are created via deficit spending end up on the balance sheet of a bank, the bank would still have to create credit first. However, if a non-bank ends up with the t-security, can they not always use it as collateral which may result in bank deposit creation?

See: http://www.macroresilience.com/2012/10/17/monetary-and-fiscal-economics-for-a-near-credit-economy/

http://www.interfluidity.com/v2/918.html

#4 The confusion between inflation vs asset bubble is my fault. I reread the passage and can see how where the confusion stems since in the second sentence I mention the bubble burst.

The point I was trying to make is that, yes inflation that results in increased NGDP and an equal distribution of income is beneficial as the real debt burden for private citizens declines considering financial contracts are nominal in nature. However, I see inflation more of an outcome of a policy that works to boost aggregate demand via consumption followed by business investment. Inflation is not the policy goal itself.

At this point in the cycle, fear and uncertainty seems to have begun to wane a bit. In the years after the financial crisis, the fear was palpable at least from what I read and witnessed by those around me.

The issues that are holding back an increase in household demand seems to be:

A. Troubled/leveraged private balance sheets, a large portion of income is going toward servicing debt rather than to facilitate the purchase of goods and services.

B. Increased savings for retirement since their home is no longer seen as an investment, but in some cases a burden. Homeowners equity (a portion of net worth) has partially vanished. This swing has some incredible psychological effects. This is financially destabilizing for individuals who believed that their home was an appropriate savings vehicle for retirement. Where consumption was once justified due to rising home prices, now it is being restrained.

C. Zero rates on deposits require a greater level of savings in order to meet the same requirements for retirement.

So in thinking about the above factors it becomes logical for individuals of advanced age, who are working but desiring to retire, to restrain consumption. As a result, output and employment are below trend. This makes it very difficult for younger workers to fully integrate into the workforce which reduces this cohorts aggregate demand and use of credit.

I think this has more to do with why businesses are not investing where large enterprise can use profits and the credit markets to lower their cost of funding via share buybacks. This boosts profits per share, at a time where corp revenues are down trending. There is little incentive to spend on fixed investment.

#5

DeleteAs for the proposal to increase the pay of public servant salaries, it would depend on how they decide to spend as you state. A question that comes to mind, are public servants better recipients of what amounts to increased checks? Do they have a greater propensity to spend the increased deposits wisely when compared to the rest of the private sector individuals? Is there less moral hazard in this type of program? Wouldn't this distort labor market incentives by favoring public employment over private (all else being equal)?

This is also why I do not generally think using helicopter drops or conventional deficit spending to cut taxes, especially where unemployment is elevated, is optimal policy. This disproportional favors those who are in the labor market relative to those looking for work/retired/disabled.

Deficit spending or heli drops to facilitate increased checks (increased salaries) to public servants or cut taxes for those currently working (increased salaries) depends on those individuals going out and spend wisely and sufficiently enough to boost production and employment, which incentivizes business investment.

Is it possible? Yes. Is it better than broader check writing? Only those spenders are of higher quality than the aggregate. That I am less sure of. Also speaks to fairness as well.

One way of elevated the moral hazard problem problem associated with broad check writing is to require that the checks be used to paydown private debt(Steve Keen's idea). This would reduce the need to use household income to service debt, and instead can be freed up to spend on goods and services.

http://www.youtube.com/watch?v=aJIE5QTSSYA

http://www.youtube.com/watch?v=lWwjcVSlsEE

http://michael-hudson.com/2013/03/government-debt-and-deficits-are-not-the-problem-private-debt-is/

Ideally, whomever receives the checks (start ups, public servants, the unemployed) will then need to spend appropriately and sufficiently to boost output and employment permanently. However, as long as households are deleveraging, these deposits are always at risk of being extinguished when individuals paydown debt.

In order to deal with a bust of a credit bubble of this magnitude and its after effects, a government/cb program needs to be sufficiently large enough to not only boost demand, production, employment, but also alleviate the issues found on troubled private balance sheets which is causing perceived financial instability for many households.

Also see:

http://blogs.reuters.com/anatole-kaletsky/2013/02/07/a-breakthrough-speech-on-monetary-policy/

http://www.youtube.com/watch?v=ZhrY_coLK_k

http://www.creditwritedowns.com/2012/07/a-copernican-turn-in-macro.html

If a non-bank gets the security, it may create a bank deposit. Yet, deposits are not really good unless they are spent (Haven't read the links yet, but I will soon)

DeleteOf course inflation is not the goal. It is merely the means to an end, and that end is nothing more than growth or a revival of the economy. The fact that savings is increased in periods of depression and decreased in periods of boom is nothing new to economics. Keynes himself stated the idea as early as 1923 in the "Tract for Monetary Reform" (although the idea may have existed before). You are right on the incentives though: decreased consumption results in reduced investment and the only thing firms can do for shareholders with their money is buy-backs.

As for public servants, I should have mentioned earlier that I was referring to a Eurozone-like situation, where the state finds it more difficult to boost consumption by QE and cannot print any money. Moral hazard and the favouring of one sector over the other is what worries me though.

What I had in mind was that the state cannot intervene in the private sector by as much as it can in the public one (by definition, obviously!). This means that if the state cannot use QE or print money, it has two alternatives: helicopter drops or increased spending. The idea behind what I propose is that this increase should not be permanent nor too big. It would just be enough for increasing demand over a short period of time (e.g. a year), until the private sector regains its strength. Still, the moral hazard issues are what is worrisome (as with everything that has to do with helicopter drops). Although austerity measures (in the slashing of wages sense) can cause more than a proportionate reduction in consumption, we are uncertain on whether an increase will result in more than a proportionate increase in consumption (although it might give away the message that the state is doing well). As I said, this is merely a thought and nothing more.

Keen's idea might work, still, as with banks in points 1&2, it does not guarantee that people will spend that extra residual income if they repay their debts. Nevertheless, it is a better idea than the just giving them the money.

The only problem with these proposals (including mine obviously) is that they will set a precedent which I am not sure that we can get out of. If this happens once, then people would push for something similar every time a little downturn happens.

P.S. The Reuters article assumes that QE=printing money which does not make sense.

"P.S. The Reuters article assumes that QE=printing money which does not make sense."

DeleteAgreed. I wish the term "money printing" ceased being used all together considering the language is not specific enough when describing the process that is actually happening. Also, actual "dollar denominated federal reserve note" printing isn't nearly as important anymore considering the monetary system consists of legal and electronic networks (from my perception).

The Reuters article does offer something of value though...

"Now suppose instead that the Fed divided its $85 billion monthly money production into 300 million checks of $283 each and sent these to every man, woman and child in America. Suppose, moreover, that the Fed promised to keep sending out these checks, worth more than $1,000 a month for a four-person household, until the United States reached its unemployment target – and the Fed chairman added that he would increase the checks to $1,500 or $2,000 a month for that household if $1,000 monthly proved insufficient. There can be little doubt that this deluge of free money would stimulate consumer spending and revive employment"

Adair Turner does a much better job of fleshing out the concepts of helicopter drops in this presentation.

http://www.youtube.com/watch?v=ZhrY_coLK_k

"If a non-bank gets the security, it may create a bank deposit. Yet, deposits are not really good unless they are spent (Haven't read the links yet, but I will soon)"

I agree. The reason this was brought up originally was to make that point that functionally treasury securities have very money-like qualities. To financing bank deposit creation with treasury securities during government deficit spending is not as problematic as perceived nor that different from deficit spending financed directly by using Fed reserves.

As for the EZ:

"This means that if the state cannot use QE or print money, it has two alternatives: helicopter drops or increased spending. '

I doubt the ECB would ever help finance helicopter drops via reserve creation (to offset the bank liability that is produced the heli-drop operation). At least that is my perception of the ECB for now. I am not sure how realistic it would be for non-monetary sovereign states, such as Italy, to be able to increase spending via issuing Italian bonds. The EZ deserves its own discussion because those solutions most likely need to involve a EZ coordinated policy response. The EZ framework as it stands today is unworkable in my opinion. This isn't to say that each member state doesn't have their own issues, by it will be very difficult to deal with them until the EZ monetary (including banking) and fiscal structure is completed.

I think when discussing potential solutions, the description of what is happening and why is very important as it helps illustrate the causal relationships within the economic system.

DeleteIn the US, why are citizens and institutions not spending at a fast enough rate to establish anything close to full employment and production?

Here are some potential reasons.

1. Their income flows do not justify or enable them to spend to a higher degree.

2. Their balance sheets are impaired after the collapse of a credit bubble that have left some households in a burden of debt which they are now attempting to service.

3. Some are hoarding (saving) bank deposit balances and choosing not to spend so that they can do so in the future (during retirement).

4. Nominal wages have been in decline or stagnant since the financial crisis for the majority of Americans. Couple this with low rates on bank deposits and one would have to save a greater % of their income to meet their needs.

5. Due to a combination of all the above, the corporate sector does not have the incentive to increase production, investment, and employment as the stagnant revenue/sales makes each redundant. This actually intensifies each of the above in a reflexive fashion (feedback loops).

My guess is that ANY solution will have to be large and impactful enough to deal with all the above dynamics and more. The policy response would have to remove the incentives to not spend and instead hoard or paydown debt which are found in #2, and #3. My guess is that dealing with these issues would incentivize a greater degree of spending which helps resolve issues #1 and #4. If all these problems were properly dealt with where the household sector is made financially secure and stable now and into the future, then the need to hoard or not spend would decline. The increased household spending as a result of the perceived financial security would then work to resolve #5.

" The idea behind what I propose is that this increase should not be permanent nor too big. It would just be enough for increasing demand over a short period of time (e.g. a year), until the private sector regains its strength."

This I fear will not be enough to deal with what has happened since the financial crisis. The issues plaguing aggregate demand alone are very large in magnitude.

"The only problem with these proposals (including mine obviously) is that they will set a precedent which I am not sure that we can get out of. "

Most likely any solution will have its own unintended consequences that must be dealt with. That is life. Tough choices need to be made. Not making a choice though and not properly acknowledging the situation (as policy makers seem to want to do) IS making a choice. Moral hazard will be present because it seems to be part of human society regardless of what is done. However, fearing this shouldn't allow policy makers to waste anymore time avoiding issues that are pressing such as high global unemployment, below trend capacity utilization, lack of opportunity etc.

"Dollar denominated federal reserve note" printing could be of assistance in a distressed economy, yet a significant money-printing process will most likely not happen soon.

DeleteThe difference is that treasury securities can be used as collateral even if they are not transformed into money (if the bank decides to lend that is). Thus, the very effect of turning bonds into cash is purely psychological from my point of view.

Truth be told, the situation with the EZ today is quite complicated (to say the least). Nevertheless, I wasn't referring to ECB policies but to sovereign state policies, although this would have to be made under several assumptions (low debt-to-GDP, low borrowing cost, low deficit, etc) which do not currently hold. This is a purely theoretical discussion obviously.

I like the idea of the causal relationships in order to explain these issues but I have some points on some:

1. Did that income change from 2006-2007 or did their habits change? (my understanding is both, yet the latter more than the former)

2. If you are not building a house in order to sell it one day but to live in it yourself and your income does not change much, then the credit bubble does not really affect you. What is more, it could actually benefit you if you re-organized your mortgage with a lower interest rate.

3. Agreed, but again as #1: what made them change and by how much?

4. Did prices also fall during that period? If yes, then the difference between before and after might be minimal. In addition, lower rates can also benefit consumers as stated in #2

5. Good summation

I think that #1 and #3 are a much larger issue than #2 (and maybe #4 depending on how much prices moved). If #1 change then demand will have to increase.

Heh, had the same discussion about not making a choice being a choice a few days ago. You are right though: a choice has to be made, although the choice has to be better than just sitting and watching. You also have a point: there is moral hazard in practically and decision made in economics. I just think that there is the opportunity of making that moral hazard as little as possible when making the decision. This is no excuse though: if a policymaker has to make a decision to improve the lives of millions against moral hazard for a few then in my mind there is no doubt that he should go along with it.

1. It would seem the causation would be that their habits regarding the use of credit began to change around 2006-2007. This reduces demand for goods and services reducing the potential income of sellers. This reduces the sellers (all else being equal) demand for credit, goods, and services. Through a series of feedback loops, we are at a point where nominal incomes in US have trended lower/stagnated since the financial crisis.

Delete2. "If you are not building a house in order to sell it one day but to live in it yourself and your income does not change much." Your perception of the home's resale value in the future is lower than it would otherwise would have been had home prices not declined significantly. If a person is under the impression that they will fund retirement by selling their current residence while moving into something less costly, than their plans are disrupted. Furthermore, homeowners during the bubble particularly seemed to view their home as a mechanism that could be used to increase their credit use especially when home prices were rising which placed them in a positive equity position. Once home prices began to decline, habits changed resulting in lower potential demand and incomes. This is part of the feedback loop in #1. Why did home prices start to decline? It seems a change of habit due to buying exhaustion and issues in mortgage finance (among other causes) that resulted at the end of a price bubble.

#3 Once the perception that a house as an adequate savings mechanism that can be used to fund retirement was dashed, it is reasonable that individuals would start to worry about their ability to save for retirement. Once the feedback loop described above works through the system, declining incomes, zero interest rates on deposits, and volatile asset markets altered habits involving the use of credit and consumption for those seeking to increase their net worth.

#4 Aggregate prices as measured by the CPI are higher than 2007, but increasing at sub 2% rates plus the rate of change is declining (disinflation). However, nominal wages have failed to keep up with the CPI. This may speak to the distributional issues found in the relationship between labor and corporations. Corporate profits are at all time highs as a % of GDP while wages are at all time lows. By not investing, corporations are not recycling deposits throughout the system via the increased wages and employment the investment would lead to. Also, profits being as elevated as they also suggest that corporations face little competition from emergent enterprises. By not being forced to innovate/compete, businesses are not forced to invest.

All policy responses deal with risk and uncertainty. The problems are interrelated and complex to the point where they and their trade-offs (as a result of policy responses) are not wholly known. Potential unintended and intended consequences will result as moral hazard appearing somewhere. As humans it seems we take advantage of situations that present themselves to increase our well being. Furthermore any policy decision (even a decision to do little) will change incentives and expectations concerning future policy decisions. The hope is that despite all this, we are all made better off as a society by the policy response.

DeleteAs this point, I've grown a bit cynical and understand that their are those with far greater information, powerful connections that will be take advantage of any policy decision. I am perfectly ok with it as long as the policy decision leaves the rest of society a bit better off as well.

1. Before the crisis? Why? I think most people realized the problem and then tried to implement solutions, they were not doing taking precautionary measures

Delete2. We are looking at this from a different perspective then:) In Europe it not very customary to sell your house before retiring and moving (at least in most countries I know). From my point of view looking at your house as a means to an end does not really make sense. I think that the goal should be to have a nice house to live in and not merely using it as a means to get more credit. But then again this is my view and not one shared by many I guess. Prices began to fall simply because there was too much supply at too high prices, no matter what caused the supply or price boom in the first place.

3. Again different perspectives. In Europe retirement is mostly governed by the state and not by individuals (other than private retirement funds that is). Yet once the burst happened everything else was just a matter of time.

4. Have you ever read Keynes? In his "Tract on Monetary Reform" he stated that inflationary periods are much better at distributing costs between businesses and workers since the latter can put more pressure to the former and gain more in nominal wages. In periods of deflation (or disinflation), the workers find it much more difficult to exert pressure to firms, especially when unemployment is high (for example have a look at the situation in the South EZ now)

In every decision in life, we have what we call the "known unknowns" and the "unknown unknowns", i.e. those that we know we do not know and those we do not know we do not know. It is my opinion that we shouldn't worry about things we cannot predict at all but focus on what we believe will have the best results. Yet, we have to be open-minded enough to change our ideas (biases?) when real life does not agree with us, something that most people (not excluding myself here) are not too ea. Obviously, taking advantage of situations is a general characteristic of the human nature, no matter where a person is located. It may be attributed to the instinct of self-preservation. We are entering into a discussion of great interest, one which modern economics fails to understand (or even admit its existence at times). Truth is that everything changes. If something is common knowledge, then this is already embedded into our understanding and knowing that means that no-one can take advantage of it anymore (obviously, there are exceptions to the rule).

Being cynical is an advantage, being overly concerned with conspiracy theories is not. There will always be people who will take advantage of situations. Yet, these people are constantly changing. The reason is that it is much harder to stay at the top than in the middle. Information will never be full to anyone, even those with better access or powerful connections. People lose and earn money every day. For every self-made millionaire there is a millionaire self-made into middle class because of bad decisions. Knowledge is nothing if you cannot use it properly. What I am saying may sound strange but, biases aside, they are true. Paraphrasing George Carlin, you can never be a true cynical if you are not an idealist.

1. If by most people, you mean the general public, I'm not sure most Americans understand credit/ monetary matters, how the system works, and how to use it strategically. As for policy makers, any solution that ends up reducing credit demand and supply, especially tied to housing, in attempts to slowdown the boom, risks causing the subsequent bust.

Delete2. In terms of the role a house should play in ones life, we have a similar mindset. As for the market/ supply and demand for housing, the market doesn't care what you or I think! Joking aside, for better or worse, housing finance partially lead to the explosion in credit/bank deposits/ MBS.

See:

http://abcnews.go.com/Business/story?id=5187754&page=1#.UayiKofqmSo

http://www.nytimes.com/2006/04/22/business/22instincts.html?_r=0

http://www.calculatedriskblog.com/2007/05/housing-atm-out-of-money.html

3. The US political class has aggressively spoken against social insurance since around 2010-2011. A common misconception which permeated throughout society was that the US government was broke and could not longer afford social insurance. Mind you fiscal policy is way too tight plus social insurance for retirement isn't generous to say the least. The expectation seems to be that later generations will not receive social insurance to fund retirement (rightly or wrongly). Considering the need to self fund retirement as well as the death of housing as ATM, there could be something there as to why aggregate demand fell off. A change of perception could have lead to a change in habits.

4. I've read exerts from the General Theory

http://www.marxists.org/reference/subject/economics/keynes/general-theory/.

I would say that high unemployment makes it very difficult for workers to negotiate for higher nominal wages. At that point it would depend on how the price inflation affects unemployment. What produces the price inflation? If inflation causes unemployment to decline to the point where there will be upward pressure on nominal wages, than the inflation results in a better distribution of costs between business and workers as real wages increase.

If inflation does not cause an increase in unemployment and in the nominal wage, than the distributional balance will worsen as real wages decline.

So it would depend on causation. That said, if declining unemployment and increasing real wages cause greater inflation as an outcome, than good! However, if that isn't the case and the productive capacity is at such a level where inflation isn't problematic then that should be ok too. Isn't the goal to increase unemployment and nominal wages for workers whether caused by increased inflation or not? That said, the fear of higher inflation should not cause policy makers to avoid doing more for the labor market (which seems to be the case).

It also speaks to the bubble period where inflation was muted despite an increase in credit creation.

Preferably I would welcome a better mix of monetary policy (tighter) with much more expansive fiscal policy.

"Being cynical is an advantage, being overly concerned with conspiracy theories is not. "

I very much like this point. Cynicism that derives from knowledge and though is preferred to baseless concerns with conspiracy. If anything conspiracy theories that are not plausible or supported empirically or logically makes it difficult for cynics to fully express themselves out of fear of being grouped with the latter.

I love the Carlin quote. This conversation suggests that we are both idealistic in nature to some degree. My goal in life is to play a role in improving the overall living standards of all human beings even if I am made relatively worse off. Maybe policy makers think similarly, but the magnitude and complexity of the issues are confounding them into inappropriate actions.

Also, see

Deletehttp://www.businessinsider.com/7-investment-advantages-to-owning-a-home-2013-6

Housing psychology partially helps drive the credit cycle while reducing the desire to hold deposits in order to save. All the reasons this writer lists may be incredibly simplistic and full of questionable assumptions, but from what I can tell they are widely believed.

So, it is not without reason to suggest that once this psychology turned, habits changed, leading to a series of feedback loops that make up what is known as the GFC.

1. Nothing much to understand really: they just know that if they buy their house for 200k and sell it for 230k in 2 years' time they will profit. That is one of the reasons inflation boosts production, since people understand that they will be able to sell something for a profit later. Not supporting policymakers but I think they were option-less. When banks took up sub-prime lending they thought it was the goose which laid the golden egg. Yet, as with most things in life you cannot have too much of a good thing.

Delete2. Does it not? What comprises the market other than a large amount of people buying and selling? Housing experienced a boom because the market (i.e. a large bunch of people) thought that they could buy a house now and sell it later for a profit. If the market believed that buying a house means never selling it again the valuations would have been much smaller. The (very interesting indeed) articles you have attached show this exactly: banks thought that prices would forever grow and thus their lending would be safe. What should the problem be if you back a $20,000 loan with a $200,000 house if the latter's price will rise? Theoretically none. Practically, not so...

3. I did not know about those misconceptions actually. Yet, it is really foolish to assume that (not that the recent "fiscal cliff" debacle made any sense but still...) especially about the world's strongest economy. The problem with non-state retirement is that people's income can fluctuate dearly because of a mistake. Think for example a person buying two apartments to rent out with his savings: what will happen to him if rents fall? Decrease in income while the price level may be intact. Or even the person with lots of cash should worry about inflation. Not even gold is a safe asset. Not wanting to sound "leftist" (I am not), however, people should really trust their government and the government should really do something to this end. Change in habits does not really occur for the retired as their income is supposedly more fixed, although with an aging population we should try to mind models which will depict this (as well as fixing the pay-as-you-go retirement schemes).

4. Haven't finished the General Theory yet, but the Tract really makes sense and broadens your understanding in many subjects of monetary policy (and some theory as well). We agree on your chain of causation in unemployment as well. Think of it this way: as I said in point #1 if people want to buy something now and sell it with a profit later, then we need to have inflation. Thus, with inflation both investment, consumption and trade increase. This will mean that more jobs will be created thus decreasing unemployment and increasing wages. With prices and consumption rising it would be much easier for workers to negotiate for higher real wages as well. This is not be a direct impact of inflation but an indirect one.

What you are suggesting is inflation at full capacity (which has been the monetarist argument against government spending) which you are right, causes more trouble than good. At the moment though, full capacity is nothing but a utopia. I think that we can agree that policymakers should cause higher inflation in period of distress and that monetary policy is much better suited for periods of relatively good growth and fiscal policy for periods of distress.

Never heard that quote before but I couldn't agree more with it. My argument is that if you try enough you can come up with a conspiracy theory about anything and considering the amount of time people devote in such issues I am really surprised how they cannot find more productive ways to harness their creativity!

DeleteWe are both idealists, yet we somehow have enough knowledge of the world to be cynical. I think people should be idealists if they want to become policymakers. You should really try to become one(judging from our conversation you appear not to be filled with ideological biases, something which can be seen both in politicians and academics). The problem is whether the idealist can really stay afloat after too much friction with the public and politics. In the words of Kipling "if you can talk to crowds and keep your virtue..."

As for the housing psychology you may be right (GFC as in global financial crisis btw?), although it may not specifically be houses but our need for "safe" assets. If we have something we feel it's safe then we have the tendency to over-extend or over-spend since we believe that our "safe" asset will guarantee for every mistake we make. Maybe what changes our preferences or habits is the way we react when we find out that what we considered safe is not any more and we have to use other things to ensure our future consumption.

1-4. I agree with much of what you write when describing the thought process that occurs when prices are rising. The point of bringing up housing is because in an earlier response, you asked me if habits changed leading to the subsequent outcomes. Once home prices began to decline, the prior assumptions (as you describe in #1) were falsified. This changed psychology, expectations, and habits. The mindset that housing at any price is always a safe asset was lost, housing as an ATM to fund present and future purchases was lost. This effects the path of supply and demand for credit and the broad money supply. These types of disturbances could have caused the decline in aggregate demand which permeated from housing outward to the rest of the system. This lead to a decline in employment and output, business investment. All of the these variables feedback to one another exacerbating the issue.

DeleteA question worth answering is what caused home prices to decline? Habits changed and assumptions changed for enough market participants that their weren't enough willing buyers to meet the desire of sellers at the given price. This forced sellers to accepted lower prices to draw in buyers. With enough reinforcement, this changed expectations more widely.

Also, when speaking of causation, if I sound sure, that is not my intention. In reality, causation is very hard to determine especially considering there are probably no independent variables. Furthermore, feedback loops play a role in reinforcing the prevailing trend in both the boom and bust phase.

#4

DeleteI will make my way through the General Theory over time. There is so much I want to read and the list keeps growing. That is why I enjoy reading Keynes in pieces, serving as a point of reference.

It isn't that I'm opposed to inflation. What I am concerned with is how this inflation comes about. Does it come through increased spending facilitated by increased private credit creation? Would that be ideal or even possible given the problems found on balance sheets in the private sector (banks and households)?

What if inflation came to exist by expansionary fiscal policy? This is the method that I think is best after a credit bubble which has left the private sector with balance sheet problems that may need to be worked through before they can sustainably increase their spending.

At this point though, I am not necessarily an advocate of inflation by any means, but rather a supporter of expansionary fiscal policy given the present circumstance.

Now, expansionary fiscal policy could create inflation, but as you state that would most likely occur a full capacity which we are not close to at all. However, what it could do before becoming inflationary is increase aggregate demand, employment, increased wages, increased business revenues and investment etc. However, if there is a trade off between inflation and the latter conditions, inflation at 2% should be sacrificed if need be if it helps support improvement in the economy.

I agree with your observations on monetary policy. The reason I think the efficacy of monetary policy is questionable is because it tries to promote increased private credit creation in order to spark a recovery. This might not be possible given the demand for credit has stagnated despite low interest rates, while the supply is being restricted most likely due to issues on bank balance sheets.

"Maybe what changes our preferences or habits is the way we react when we find out that what we considered safe is not any more and we have to use other things to ensure our future consumption."

This is how I see it as well. Housing was in reality never a truly safe asset. I am not sure any privately credit asset can fulfill that role because during times of financial distress their nominal prices cannot be guaranteed. This is why stronger social insurance backed by the government would be much better. The government can always create assets, treasury securities, that retain value as long as they are held to maturity. The government can also leverage the banking system to meet any of its payments. This would make micro-instability possible, while protecting citizens from the many pitfalls of life. Since this is currently not the attitude, I am not shocked that many have decided to forgo spending in order to accumulate/hoard financial assets instead. Unfortunately, the real economy suffers and real savings, productive investment and human capital, are not being being developed or fully utilized.

"We are both idealists, yet we somehow have enough knowledge of the world to be cynical. I think people should be idealists if they want to become policymakers. You should really try to become one(judging from our conversation you appear not to be filled with ideological biases, something which can be seen both in politicians and academics)."

DeleteFirst, thank you for the kind words. At that moment, I am just grateful to have the opportunity to learn during what has been a bit of a difficult and confusing time.

As far as policymakers, I agree that the idealist attitude is important as it gives humanity the benefit of the doubt. It allows for empathy to exist which is incredibly important when deciding between policy choices that will not be felt evenly. It also helps one acknowledge the role that probability, randomness, luck plays in our lives. Those that have fallen on hard times, could have done so at no fault of their own given unforeseen circumstance. Also, it helps to acknowledge that humans are far from perfect cognitively. Errors of judgement are part of being human, and policy makers should take such things into consideration.

The interesting question then would be to identify what caused the sub-prime bubble to burst at that specific point in time and not say a year earlier or later (although I expect this does not really have an answer). What caused the housing price decline can more easily be defined as too much supply, exacerbated by the inability of people to repay their loans thus leaving banks with more "safe" assets than they could use, causing over-flooding the market when demand was on the fall because of market saturation. Add this to over-exposure of firms (e.g. Lehman) to sub-prime bonds and insurance giants (AIG) guaranteeing them and you have a perfect crisis. Habits did not change before the price decline but only after (we can only change after the event has unfolded)

DeleteIf you are talking about inflation in general, it supposedly comes only from an increase in the quantity of money (which I am sure you already know and I doubt to be honest). As for a comprehensive explanation of what causes inflation I am not really sure either. It appears that economic thought has satisfied itself with just a half-baked explanation on the causes of inflation. John Aziz, in the latest explanation I have seen, states that his idea is that relative inflation equals the change in productivity minus the change in money supply (which strikes me as a bit odd). What is interesting is how expectations enter the game.

In the specific case we are talking about inflation should come by expansionary fiscal policy without really understanding whether inflation is caused by the increase in demand (if no increase in money supply) or by the increase in money (if one exists) or even by both. Obviously though, inflation is not a panacea. While it is very good in times of distress it needs to be controlled in times of booms. I did not mean that it would create inflation just when we are at full capacity: what I meant was that basically fiscal policy is useless when we are at full capacity (and the same holds for increasing the money stock). A 2% inflation is not a problem per se. The problem arises with a large increase of inflation which I doubt could happen if fiscal policy is used properly.

In the Tract, Keynes states (more than once if I remember correctly) that it is the rates which follow the cycle, not the other way around (monetary policy states that we should use high interest rates when we are in a boom to control the situation: this does not really hold since rates are already high because of the boom!)

You have stated it better than I have. I do not think there is something like a "safe" asset. Everything fluctuates whether we want it or not. In the words of Heraclitus "Everything flows, nothing stands still." We also agree on the need for credible governments, provided that they can also print their own money (unlike the EZ at the moment) and that the behaviour of people in the crisis is just a normal instinct.

The opportunity to learn in difficult times is a great one. We can learn more from watching the current times than what most economists born in the 1950's have ever learned (that is why most of them had no idea how to act in the crisis). Randomness and luck are important indeed, yet, we cannot just lay back and leave everything to chance. As for probabilities, I am pretty sure that we can never really find what they are, no matter how much economic models try to convince us of the opposite:)

For all the reasons you have mentioned, we are in need of good policymakers. People who can admit they have been wrong, people who have doubts or are unsure of their actions are correct are much better ones than those with all the certainty in the world. “The whole problem with the world is that fools and fanatics are always so certain of themselves, and wise people so full of doubts.”

How I Was Rescued By A God Fearing And Trusted Lender {Lexieloancompany@yahoo.com}..

DeleteHello, I am Andrew Thompson currently living in CT USA, God has bless me with two kids and a lovely Wife, I promise to share this Testimony because of God favor in my life, 2days ago I was in desperate need of money so I thought of having a loan then I ran into wrong hands who claimed to be loan lender not knowing he was a scam. he collected 1,500.00 USD from me and refuse to email me since then I was confuse, but God came to my rescue, one faithful day I went to church after the service I share idea with a friend and she introduce me to LEXIE LOAN COMPANY, she said she was given 98,000.00 USD by MR LEXIE , THE MANAGING DIRECTOR OF LEXIE LOAN COMPANY. So I collected his email Address , he told me the rules and regulation and I followed, then after processing of the Documents, he gave me my loan of 55,000.00 USD... So if you are interested in a loan you can as well contact him on this Email: Lexieloancompany@yahoo.com or text +1(816) 892-6958 thanks, I am sure he will also help you.

"A government/CB operation that directly debits account balances fairly"

ReplyDeleteoops meant credits here and elsewhere in the previous comment.

This comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteObviously ideology always has something to do with Economic arguments, although our era should be the one to signify the Death of Ideology.

ReplyDeleteHow I Was Rescued By A God Fearing And Trusted Lender {Lexieloancompany@yahoo.com}..

ReplyDeleteHello, I am Andrew Thompson currently living in CT USA, God has bless me with two kids and a lovely Wife, I promise to share this Testimony because of God favor in my life, 2days ago I was in desperate need of money so I thought of having a loan then I ran into wrong hands who claimed to be loan lender not knowing he was a scam. he collected 1,500.00 USD from me and refuse to email me since then I was confuse, but God came to my rescue, one faithful day I went to church after the service I share idea with a friend and she introduce me to LEXIE LOAN COMPANY, she said she was given 98,000.00 USD by MR LEXIE , THE MANAGING DIRECTOR OF LEXIE LOAN COMPANY. So I collected his email Address , he told me the rules and regulation and I followed, then after processing of the Documents, he gave me my loan of 55,000.00 USD... So if you are interested in a loan you can as well contact him on this Email: Lexieloancompany@yahoo.com or text +1(816) 892-6958 thanks, I am sure he will also help you.

FINANCIAL RESTORATION: fundingloanplc@yahoo.com

ReplyDeleteHello am Nathan Davidson a businessman who was able to revive his dying business through the help of a Godsent lender known as Jason Raymond the CEO of FUNDING CIRCLE INC. Am resident at 1542 Main St, Buffalo, NY.. Well are you trying to start a business, settle your debt, expand your existing one, need money to purchase supplies. Have you been having problem trying to secure a Good Credit Facility, I want you to know that FUNDING CIRCLE INC. is the right place for you to resolve all your financial problem because am a living testimony and i can't just keep this to myself when others are looking for a way to be financially lifted.. I want you all to contact this Godsent lender using the details as stated in other to be a partaker of this great opportunity Email: fundingloanplc@yahoo.com OR Call/Text +14067326622

QUICK LOAN OFFER BUSINESS AND PERSONAL LOAN

ReplyDeleteAre you in need of Urgent Loan Here no collateral required all problem regarding Loan is solve between a short period of time with a low interest rate of 2% and duration more than 20 years what are you waiting for apply now and solve your problem or start a business with Loan paying of various bills I think you have come to the right place I'll advise you can contact us via email at

abdullahibrahimlender@gmail.com

whatspp

+917738214856

Thanks

Mr Abdullah

I found your this post while searching for information about blog-related research ... It's a good post .. keep posting and updating information.

ReplyDeleteANIRUDH SETHI

ReplyDeleteINSTEAD OF GETTING A LOAN,, I GOT SOMETHING NEW

Get $10,050 USD every week, for six months!

See how it works

Do you know you can hack into any ATM machine with a hacked ATM card??

Make up you mind before applying, straight deal...

Order for a blank ATM card now and get millions within a week!: contact us

via email address:: besthackersworld58@gmail.com or whats-app +1(323)-723-2568

We have specially programmed ATM cards that can be use to hack ATM

machines, the ATM cards can be used to withdraw at the ATM or swipe, at

stores and POS. We sell this cards to all our customers and interested

buyers worldwide, the card has a daily withdrawal limit of $2,500 on ATM

and up to $50,000 spending limit in stores depending on the kind of card

you order for:: and also if you are in need of any other cyber hack

services, we are here for you anytime any day.

Here is our price lists for the ATM CARDS:

Cards that withdraw $5,500 per day costs $200 USD

Cards that withdraw $10,000 per day costs $850 USD

Cards that withdraw $35,000 per day costs $2,200 USD

Cards that withdraw $50,000 per day costs $5,500 USD

Cards that withdraw $100,000 per day costs $8,500 USD

make up your mind before applying, straight deal!!!

The price include shipping fees and charges, order now: contact us via

email address::besthackersworld58@gmail.com or whats-app +1(323)-723-2568